We use cookies, including cookies from third parties, to enhance your user experience and the effectiveness of our marketing activities. These cookies are performance, analytics and advertising cookies, please see our Privacy and Cookie policy for further information. If you agree to all of our cookies select “Accept all” or select “Cookie Settings” to see which cookies we use and choose which ones you would like to accept.

Stock information

Our stock information includes various quotes, chart analyses, and foreign holdings for current and potential investors.

Stock quotes

Issued stocks

Capital stock

| Item | Number of issued stocks | Amount (in thousands of KRW) | Ratio (%) |

|---|---|---|---|

| Common stock | 163,647,814 | 818,239,070 | 90.5 |

| Preferred stock | 17,185,992 | 85,929,960 | 9.5 |

| Total | 180,833,806 | 904,169,030 | 100 |

Changes in capital stock

| Date | Content | Type | Quantity (shares) | Face value per share (in KRW) | Issued value per share (in KRW) | Capital after changes (in thousands of KRW) |

|---|---|---|---|---|---|---|

| 2011.12.29 | Rights offering | Common stock | 190,000 | 5,000 | 51,600 | 818,239,070 |

| Preferred stock | - | - | - | 85,929,960 | ||

| 2006.02.03 | Overseas CB | Common stock | 187,657 | 5,000 | 68,900 | 723,239,070 |

| Conversion | Preferred stock | - | - | - | 85,929,960 | |

| 2006.02.02 | Overseas CB | Common stock | 438,049 | 5,000 | 68,900 | 722,300,785 |

| Conversion | Preferred stock | - | - | - | 85,929,960 | |

| 2006.01.26 | Overseas CB | Common stock | 637,346 | 5,000 | 68,900 | 720,110,540 |

| Conversion | Preferred stock | - | - | - | 85,929,960 |

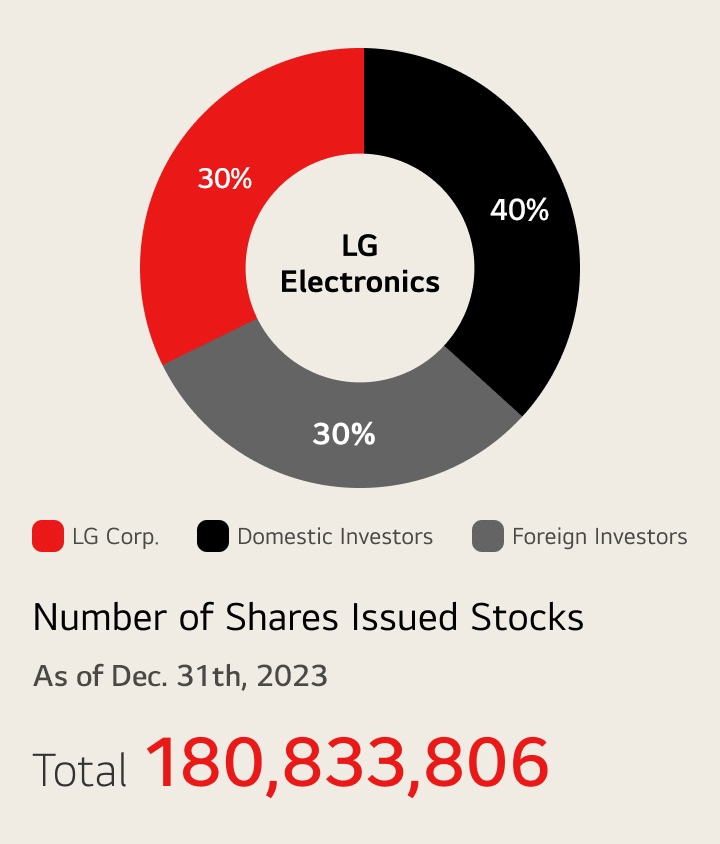

| 2023 | 2022 | 2021 | |

|---|---|---|---|

| LG Corp. | 30% | 31% | 31% |

| Foreign investors | 30% | 28% | 30% |

| Domestic investors | 40% | 41% | 39% |

The above percentages are based on data collected at the year-end

Dividends

Our shareholder returns are made through annual dividends, which are determined by comprehensively considering future strategic investments within the scope of dividend income, financial structure(cash flow etc.) and business environment with a priority on increasing shareholder value and increasing shareholder returns.

In accordance with the mid-to long-term dividend policy announced on March 26th, 2024, we plan to return "more than 25% of net profit (excluding one-off non-recurring profit, based on profit attributable to owners of the parent) of consolidated financial statements, minimum 1,000 won per common share per year" to the shareholders over the next three years (FY2024 ~FY2026).

Starting from the 2024 fiscal year, we will conduct semi-annual dividends, and from the dividend of the 2024 fiscal year, we plan to enhance dividend predictability for investors by first determining the dividend amount and then setting the dividend record date (as resolved by the board of directors).

※ Dividend per share in 2023: Common stock 800 Korean Won, Preferred stock 850 Korean Won

| 2023 (22th) | 2022 (21th) | 2021 (20th) | 2020 (19th) | 2019 (18th) | 2018 (17th) | 2017 (16th) | 2016 (15th) | 2015 (14th) | 2014 (13th) | 2013 (12th) | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Face value per share (KRW) | Common | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 |

| Preferred | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | |

| Cash dividend per share (KRW) | Common | 800 | 700 | 850 | 1,200 | 750 | 750 | 400 | 400 | 400 | 400 | 200 |

| Preferred | 850 | 750 | 900 | 1,250 | 800 | 800 | 450 | 450 | 450 | 450 | 250 | |

(Consolidated) Net income (KRW billion) | 712.9 | 1,196.4 | 10,317 | 19,683 | 313 | 12,401 | 17,258 | 769 | 1,244 | 3,994 | 1,768 | |

Total cash dividends (KRW billion) | 144.9 | 126.9 | 1,539 | 2,169 | 1,359 | 1,359 | 729 | 729 | 729 | 729 | 369 | |

(Consolidated) Cash dividends payout ratio (%) | 20.3 | 10.6 | 14.9 | 11.0 | 434.4 | 11.0 | 4.2 | 94.8 | 58.6 | 18.3 | 20.9 | |

Cash dividend yield (%) | Common | 0.8 | 0.8 | 0.6 | 1.1 | 1.0 | 1.2 | 0.4 | 0.8 | 0.8 | 0.7 | 0.3 |

| Preferred | 1.8 | 1.7 | 1.4 | 2.5 | 2.8 | 3.1 | 1.0 | 1.9 | 1.6 | 1.6 | 1.0 |